iowa property tax calculator

Iowa Tax Proration Calculator. The median property tax on a 13680000 house is 176472 in Iowa.

Those Crazy Iowa Property Taxes Home Sweet Des Moines

Total Amount Paid Rounded Up to Nearest 500 Increment Exemption -.

. Iowa Real Estate Transfer Tax Calculator Transfer Tax 711991 thru the Present. What is Transfer Tax. Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents.

The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. The median property tax on a 9040000 house is 131080 in Des Moines County. Enter amount paid in the box below exclude commas and dollar signs then click submit.

Property tax proration calculator iowa real estate. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Jackson County. The median property tax on a 9040000 house is 116616 in Iowa.

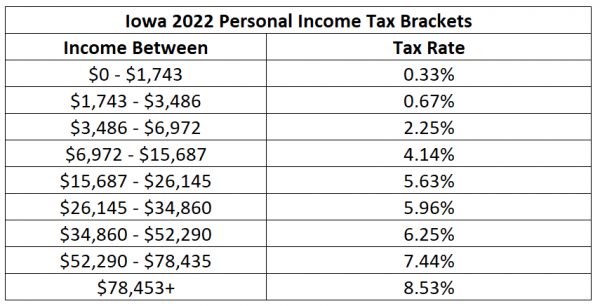

January 1 2020 Assessed Value. So if you pay 2000 in Iowa state taxes and your school district surtax is 10 you have to pay another 200. How are property taxes calculated in Iowa.

Assessed value to which tax rates apply is based on market value. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid. The median property tax on a 10610000 house is 136869 in Iowa.

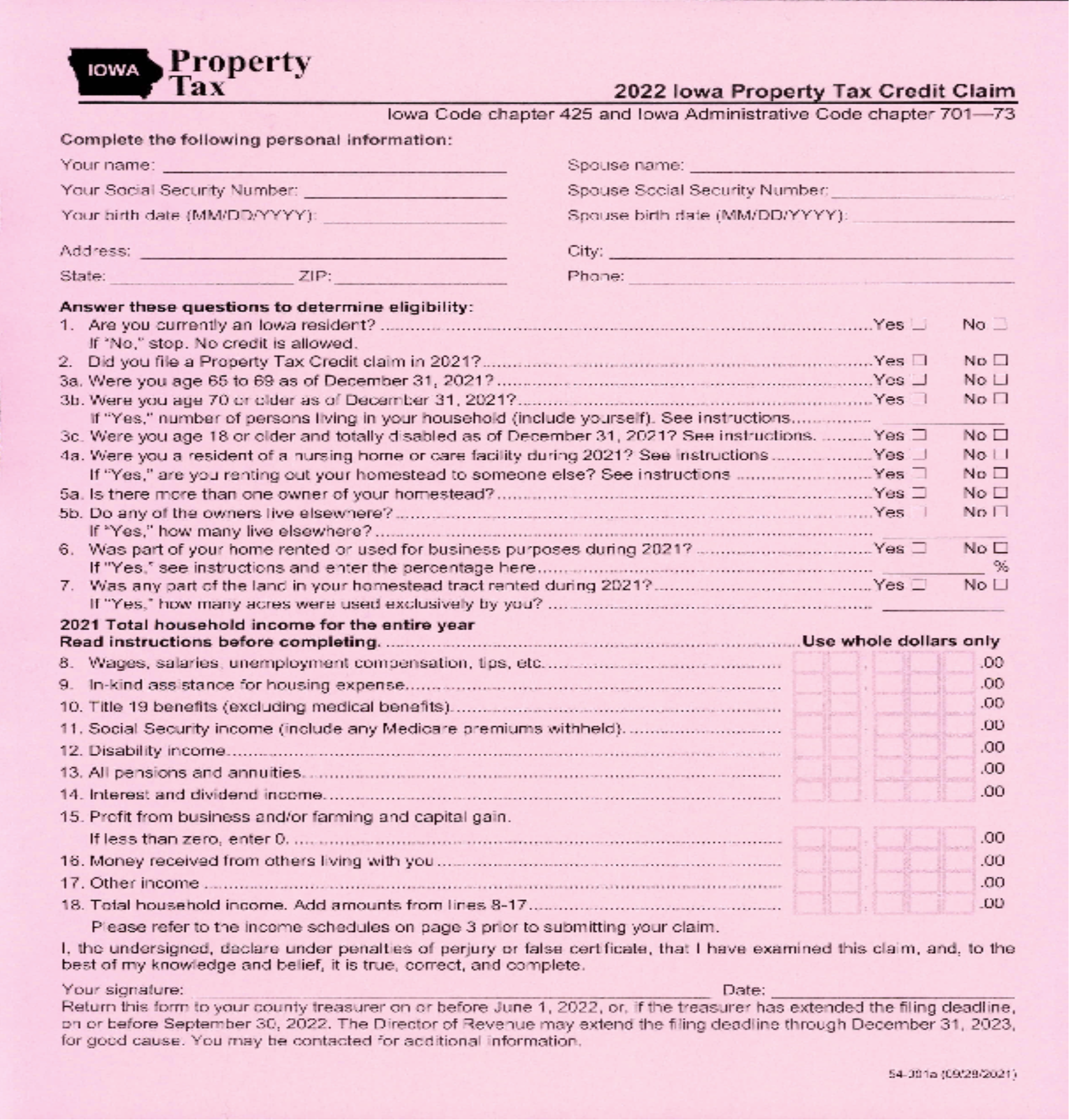

The assessor or the Iowa Department of Revenue estimates the value of each property. The median property tax in Iowa is 156900 per year for a home worth the median value of 12200000. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a.

Example 1 - 1000 property taxes with a closing date of February 1. Type your numeric value in the appropriate boxes then click anywhere outside that box or press the tab key for the total amount Due. If you know the amount of Transfer Tax Paid and want to determine the.

You may calculate real estate transfer tax by entering the total amount paid for the property. Annual property tax amount. This reduction in the amount of credits and exemptions will occur when the amount of funding received from the State for the credits and exemptions is less than the calculated amount of credits and exemptions for each applicable taxable property.

This Calculation is based on 160 per thousand and the first 500 is exempt. Fields notated with are required. The value of property is established.

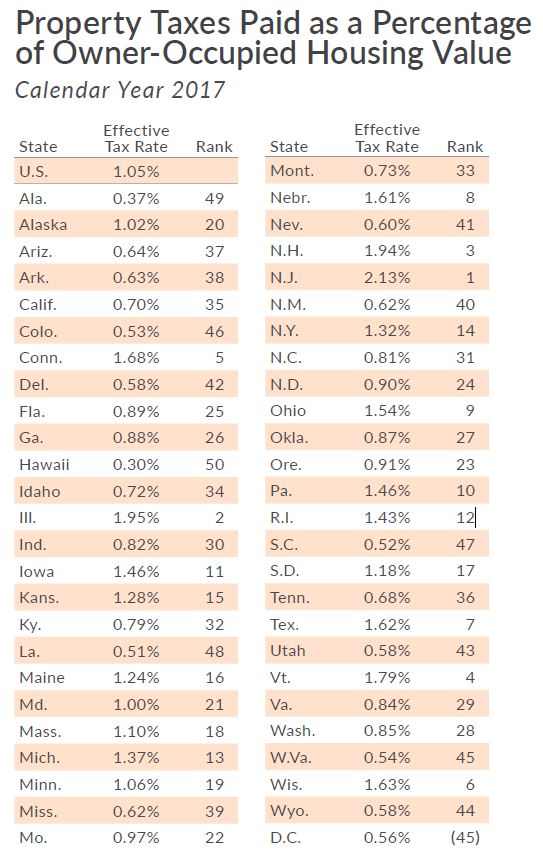

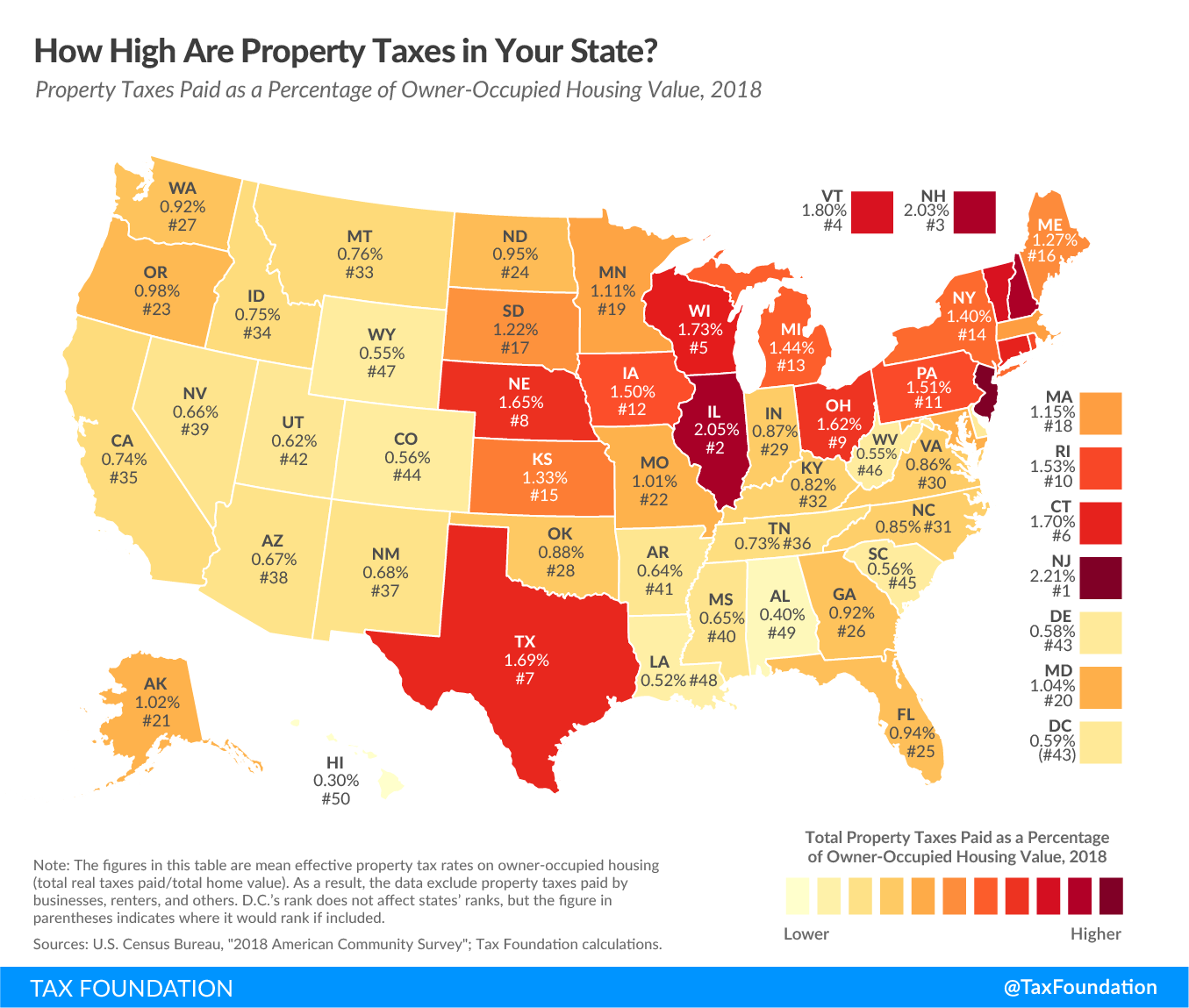

Iowa Tax Proration Calculator Todays date. Ad Look Up Any Address in Iowa for a Records Report. Iowa is ranked number twenty eight out of the fifty states in order of the average amount of property taxes collected.

The first half or 500 of the previous years taxes was paid in September and the second 500 will assumingly be paid on March 1. Since the closing date is on February 1 the current taxes due are 500 and the prorated taxes for the current fiscal year are calculated from July 1 through January 31. This calculation is based on 160 per thousand and the first 50000 is exempt.

In Iowa you must file an income tax return if you made more than 9000 and your filing status is single or if you made more than 13500 and have any other filing statusIf you were a non-resident you must pay Iowa income taxes if you made 1000 or more from Iowa sourcesSince the average household in Iowa makes 58570 annually according to 2017 census data most. The median property tax on a 10610000 house is 111405 in the United States. Property values in Iowa are assessed every two years by county and city assessors.

Counties in Iowa collect an average of 129 of a propertys assesed fair market value as property tax per year. The assessed value of the property and the total local tax rate. The countys average effective property tax rate is 197 which is the highest rate in.

If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer. The tax is imposed on the total amount paid for the property. Do not type commas or Dollar signs Into number fields.

The median property tax on a 13680000 house is 143640 in the United States. Find Records For Any City In Any State By Visiting Our Official Website Today. 4 Reduces Taxable Value by 4850 pursuant to Iowa Code Section 4251.

To view the Revenue Tax Calculator click here. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000.

Your average tax rate is 1198 and. Check the chart below for the surtax rates for Iowa school districts. Annual property tax amount.

Taxes are based on two factors. Our Iowa Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Iowa and across the entire United States. See Results in Minutes.

The assessments of all taxable properties are added together. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Iowa Income Tax Calculator 2021.

If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. Property Tax Calculator Type your numeric value in the appropriate boxes then click anywhere outside that box for the Annual Gross Total to appear. The highest property tax rates in the county can be found in des moines.

Tax amount varies by county. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. This is called the assessed value The assessed value is to be at actual or market value for most property taxes.

This calculation is based on 160 per thousand and the first 500 is exempt. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Dubuque County. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

The median property tax on a 9040000 house is 94920 in the United States.

How Do State And Local Individual Income Taxes Work Tax Policy Center

Iowa Reduces Corporate Individual Income Tax Rates Grant Thornton

How Do Iowa S Property Taxes Compare Iowans For Tax Relief

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Property Taxes West Des Moines Ia

How Much Are Real Estate Taxes At Closing In The Iowa City Area

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Iowa S High Property Taxes Iowans For Tax Relief

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

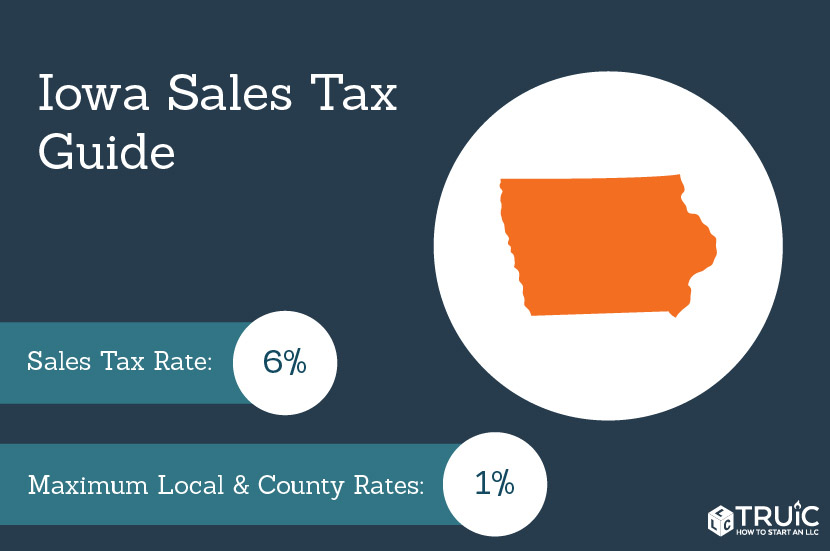

Iowa Sales Tax Small Business Guide Truic

Calculating Property Taxes Iowa Tax And Tags

Property Taxes West Des Moines Ia

Property Taxes Property Tax Analysis Tax Foundation

Iowa Property Taxes By County 2022

Iowa Income Tax Calculator Smartasset